It’s hard enough to time investments. Finance theory says it’s impossible and there is plenty of evidence to prove that it can’t be done. So it should come as no surprise that timing a home purchase would be even more difficult.

As I’ve said before, I don’t think people should think of a home as an investment. If it were, it would be the only one that regularly springs leaks, begs for a makeover, and falls apart over the course of 30 years (maybe sooner depending upon your builder). Regardless of what the National Association of Realtors would like you to believe, a home is simply a lifestyle purchase, with some pretty hefty financial considerations. Therefore, the timing of when to buy a home should be largely influenced by lifestyle goals.

That doesn’t mean that there aren’t times when it’s prudent to wait for homes to “go on sale” – such as the last few years. But trying to pick the absolute bottom of the housing market is a fool’s errand. And it’s not just because you don’t know where the price of housing is going. You also have to figure in the impact of mortgage rates, which can have an even bigger impact on the cost of housing than the price of the house.

Let me demonstrate. Consider the purchase of a $500,000 home with 20% down and a 5.1% mortgage. Your monthly payment would be $2,171.80. However, if mortgage rates go up by 100 basis points to 6.1% then the price of the home would have to drop to $458,386 in order for you to have the same monthly payment with the same down payment. That’s an 8.3% price drop. So you have to ask yourself what is more likely at this stage: that housing prices will drop another 8.3% or that mortgage rates will go up by another 100 basis points? How about another 200 basis points?

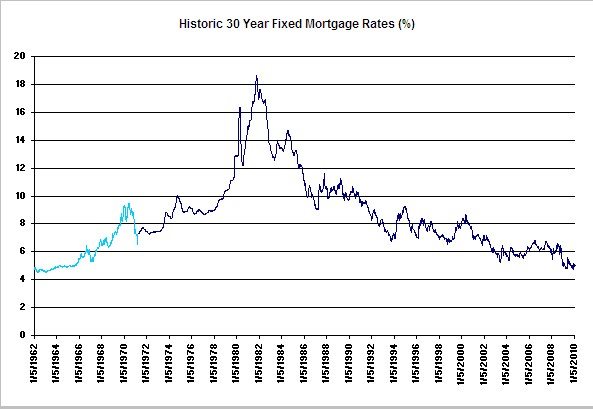

Look at where Chicago housing prices are right now relative to their long term trend. I’m not saying that they are a steal but they are certainly fairly priced relative to where they have historically been. Now look at mortgage rates. Recently they have been at the lowest level in the past 50 years! I pulled the data below from the Federal Reserve and since that series doesn’t go past April, 1971 I estimated the prior data back to January, 1962 (light blue line) based upon the rate on 10 year treasuries. That estimate is a bit crude but the conclusion is still the same since 10 year treasuries are now at lower rates than they were in 1962.

But what about this debate that rising interest rates will depress home prices? Well, let’s look at the period from the 60s to the 80s when 30 year rates went up from around 5% to 18%. According to the theory, during that period, home prices would have dropped by almost 52%! Well, they didn’t.

I’m trying to avoid repeating the realtor’s mantra of “now is the time to buy” because it really does sound lame and self-serving. However, the fact of the matter is that current conditions are extremely favorable for buying.